Try truuth KYC for free – no contracts, no fees, no hassles. You can customize the KYC service with your company logo and brand colors.

Option for enterprises to capture both face and voice biometrics during enrolment to mitigate fraud.

Multiple Machine Learning models generate real time confidence scores to protect against identity theft.

Combine our features to create a customised KYC user flow for your business.

Get up and running in minutes. No setup fees and no minimum spend commitment.

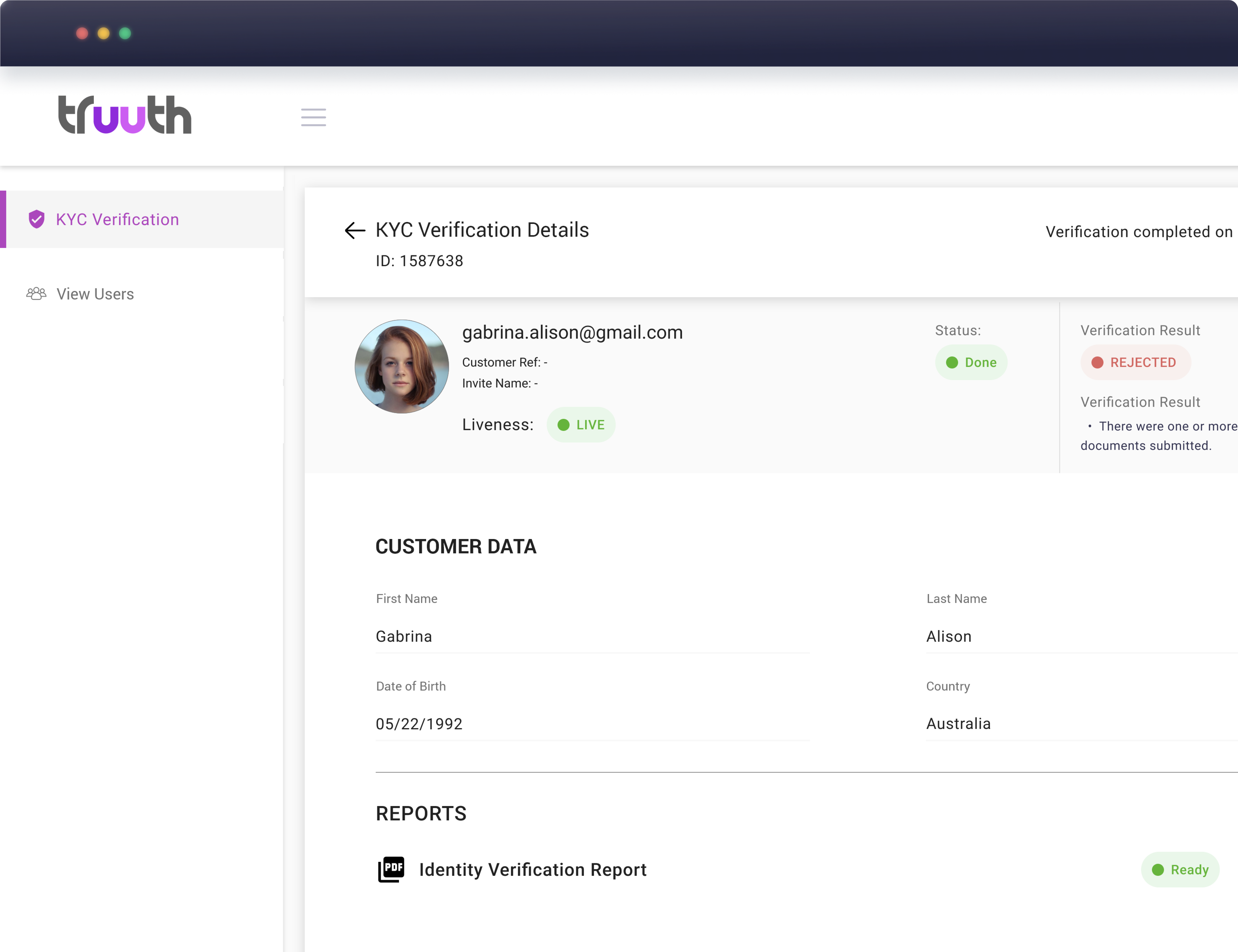

Ensure compliance with KYC, AML, CTF obligations with secure storage of identity proofing evidence and audit trail.

Machine Learning models check for fraudulent manipulation of ID documents.

Option for enterprises to capture both face and voice biometrics during enrolment to mitigate fraud.

Multiple Machine Learning models generate real time confidence scores to protect against identity theft.

Combine our features to create a customised KYC user flow for your business.

Get up and running in minutes. No setup fees and no minimum spend commitment.

Ensure compliance with KYC, AML, CTF obligations with secure storage of identity proofing evidence and audit trail.

Machine Learning models check for fraudulent manipulation of ID documents.

You can be up and running with your own branded digital KYC service in less than 15 minutes.

There are no set up costs and the first 25 KYC events are free so you can trial the service at no cost.

Send a KYC invite to the user’s email address or copy a unique link into an onboarding email.

Truuth can take responsibility for securely storing KYC results or you can retrieve results via API.

truuth KYC enables seamless onboarding of customers, employees, and suppliers.

Onboard customers with complete assurance of their identity in less than 60 seconds.

Automation can speed up onboarding by weeks and reduce associated costs by thousands

Improve customer experience by onboarding customers with confidence in less than 2 minutes

Choose from a comprehensive range of services that deliver complete assurance in user identity.

Seamlessly onboard customers, employees, and suppliers with complete assurance in their identity.

Protect your users from fraudulent actors trying to steal their identity.

Choose from a wide range of verification checks that provide assurance in user credentials.

Extract data from identity documents with a high level of assurance.

Check the user’s face matches their identity document.

Improve user experience and data security with face authentication.

Check the authenticity of an extensive range of global identity documents.

Extract data from a wide range of invoices and statements.

Verify the identity of your users from their enrolled voice sample.

Go passwordless and empower users to login with any combination of biometrics.

Configure a solution that’s perfect for your enterprise. Truuth offers flexibility to add or remove features at any time.

Check visa status to determine eligibility to work.

Check applicant details against a global database of Politically Exposed Persons.

Check applicant details against international sanctions lists.

Check the credit history of a business.

Check the ownership structure of a business.

Check if applicant has been in the press for the wrong reasons.

Check if applicant has court rulings or actions pending.

Check if applicant has a police record.

Check if applicant has a valid trade licence.

Check if applicant is certified to work with children.

Company report

Check company details match official records.

Join other established names in the region to future-proof your organisation.

6/201 Kent Street, Sydney NSW 2000, Australia

Contact us today for more information, or to request a free demo of our latest services.

Copyright © truuth™ 2022. All rights reserved. ACN: 630466741. Iocii Innovation Pty Ltd.

Please enter your information below and we will be in touch.

Drop us a line and we will get back to you soon!